VAT Penalties & VAT Interest changes from 1st January 2023

For VAT periods starting on or after 1 January 2023, the default surcharge will be replaced by new penalties if you submit VAT returns late or pay VAT late.

Who is affected

Everyone submitting VAT Returns for accounting periods starting on or after 1st January 2023 will be affected and any nil or repayment VAT returns that are submitted late will also receive late submission penalty points and financial penalties.

If you submit your VAT return late

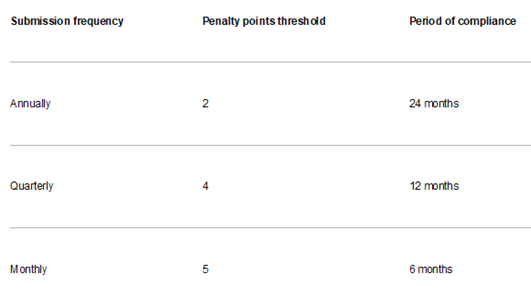

Late submission penalties will work on a points-based system.

For each VAT Return you submit late you will receive one late submission penalty point.

Once a taxpayer reaches a certain penalty threshold, they will get a £200 penalty. After this, a further £200 penalty will be issued for each subsequent late submission.

Penalties for late VAT payment

Late payment penalties will be due if the VAT payment is not made on time, even if you have submitted your vat return on time.

The amount depends on how late the payment is, the sooner it’s paid the lower the penalty will be.

-

Late payment up to 15 days overdue

You will not be charged a penalty if you pay the VAT you owe in full or agree a payment plan on or between days 1 and 15.

- VAT payment is between 16 and 30 days overdue

You will receive a first penalty calculated at 2% on the VAT you owe at day 15 if you pay in full or agree a payment plan on or between days 16 and 30.

- VAT payment is 31 days or more overdue

You will receive a first penalty calculated at 2% on the VAT you owe at day 15 plus 2% on the VAT you owe at day 30.

You will receive a second penalty calculated at a daily rate of 4% per year for however long the outstanding balance is due. This is calculated when the outstanding balance is paid in full or a payment plan is agreed.